Modernizing laws to uplift Minnesotans – Newsroom

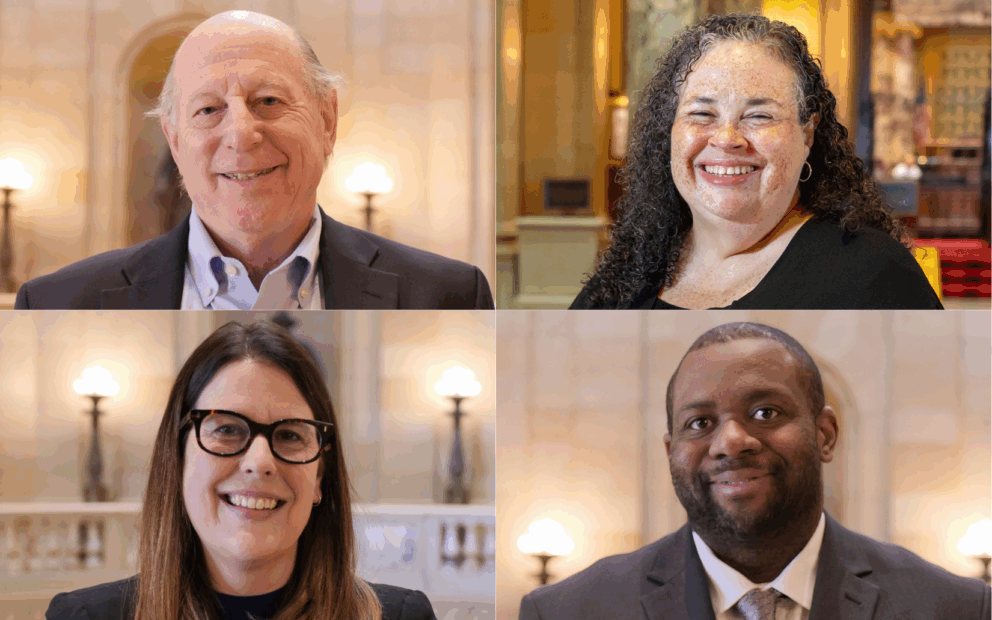

Vast, complex and never easy is the work undertaken by our Legal Services Advocacy Project. In 2024, LSAP Attorneys Jessica Webster, Ellen Smart, Andrew Knox III, led by Supervising Attorney Ron Elwood, set sights on modernizing laws to further economic justice. Notable examples of 2024 session work are below, but be sure to catch up on our just released 2025 Legislative Summary.

Contract for deed

When homeownership is elusive for low-income people who don’t qualify for a mortgage —because they have a poor credit history or no credit history or won’t pursue one for religious reasons — a Contract for Deed is the alternative. But as Ron explains, “CFD is an odd legal duck. Many entering into these agreements haven’t understood the terms because they were never explained.”

He says that, prior to reforms for which LSAP advocated, buyers had few protections. For example, “After months of payments, unsuspecting buyers could be hit with a balloon payment of hundreds of thousands of dollars,” which, of course, they cannot make. “And missing a single payment meant they could lose the home and all the money they put into it in as little as 60 days.”

Contract for deed was traditionally a viable alternative path to homeownership, with individuals selling to individuals — a parent selling the home to a child; a longtime renter buying a home from a landlord retiring to another state.

But there is dark underside to these transactions. Flipping — the practice of buying underpriced and distressed properties and reselling them, often at inflated prices — became prevalent in Contract for Deed transactions. This practice particularly victimized Somali and Latino communities.

“Although there are some legitimate, good faith owners, the bad investor sellers lure in hopeful homeowners, then pull out the rug.” They do this over and over, preying on vulnerable people, desperate to someday own a home.

Now, after a successful push at the Capitol, it’s the law that CFD sellers must inform buyers of the terms, and they must do so 10 days before entering into the contract. It also extended grace periods, prohibited flipping and gives buyers strong remedies for violation. This includes the ability to recover damages and to get a refund of all the money previously paid. Ron says 2024 updates to CFD law as “the largest reforms in this area, maybe ever.”

Update Contract for Deed Required Disclosures

The disclosure must be provided 10 days prior to the signing of the contract and must include:

- The amount and due date of all balloon payments.

- The price paid to acquire the property being sold (if acquired the property within the last two years).

- The cost and essential terms of the sale; and

- A general “disclosure that provides important basic information and warnings to a potential buyer. And, disclosures must be in a language other than English if the transaction was negotiated in that language.

Debt Fairness Act

Working closely with the Attorney General’s office, Ron and Andrew Knox III, with special insights from Supervising Consumer Attorney Beth Goodell, helped make significant inroads on protecting consumers with the Debt Fairness Act.

Medical Debt

In the past, Ron says, a health care provider could say, “Oh, you need follow up for your broken arm? Pay us, then we’ll treat you. Oh, you want us to treat your kidney failure? First, pay 100% of what you already owe.”

Now, thanks to the Debt Fairness Act, it is illegal in Minnesota for providers:

• to deny care because you have medical debt.

• to report medical debt to a credit reporting agency.

• to come after you for medical debt of a spouse who has passed away.

Garnishment

When it comes to wage garnishment — the lawful practice of a creditor taking a portion of an individual’s paycheck to satisfy a debt — the Debt Fairness Act in 2024 increased protections for all consumers, particularly for those on public assistance.

“Say you have a car. Say you’re getting benefits.” Ron continues, “Garnishment laws protected only $2,500 of property or money from being taken. Because car values are significantly more than when these laws were written, a car could be seized.”

Today, the Debt Fairness Act increased asset protections by providing:

• Assurances that creditors cannot seize low-income tax credits, like the Earned Income Tax Credit, from individuals getting public assistance.

• A progressive, tiered structure allowing individuals of lowest-income to keep a higher percentage of their paycheck.

• Protections on earnings of both self-employed entrepreneurs and independent contractors. (Previous protections extended to employed workers but not to self-employed contractors. This had meant 100% of a self-employed person’s income could be garnished.)

Renters who are survivors of domestic violence

Almost 15 years ago, Legal Aid successfully advocated for a law that allows survivors of domestic violence to break their lease if they need to flee abuse. In 2024, this law was strengthened to:

• Verify documents can be obtained remotely.

• Impose harsh penalties will be imposed if the landlord breaks confidentiality by disclosing survivor status.

• Prohibit landlords cannot file an eviction against a survivor of domestic violence who fled, if later named as the lease holder and, if a landlord illegally files an eviction, the survivor is entitled to an expungement of that eviction from the survivor’s record.

In the end, these reforms are good for all Minnesotans. But Ron reminds us, “Legal Aid clients experiencing inequities and devastating setbacks are the ones who shine the light on injustice. We thank them for guiding us in the mission to pursue stronger, better, more just laws.